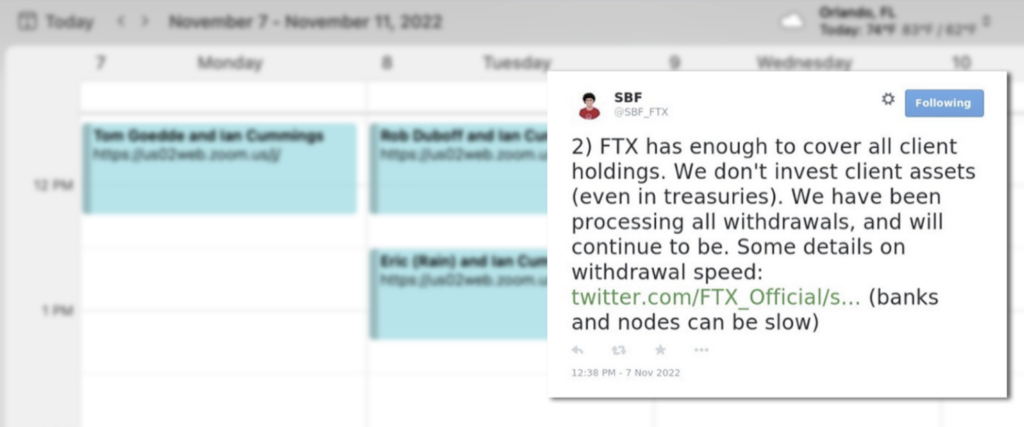

Now that the ink has dried, I thought it might be cathartic to look back and discuss what all went down as I started the fundraising process literally the same week FTX cratered.

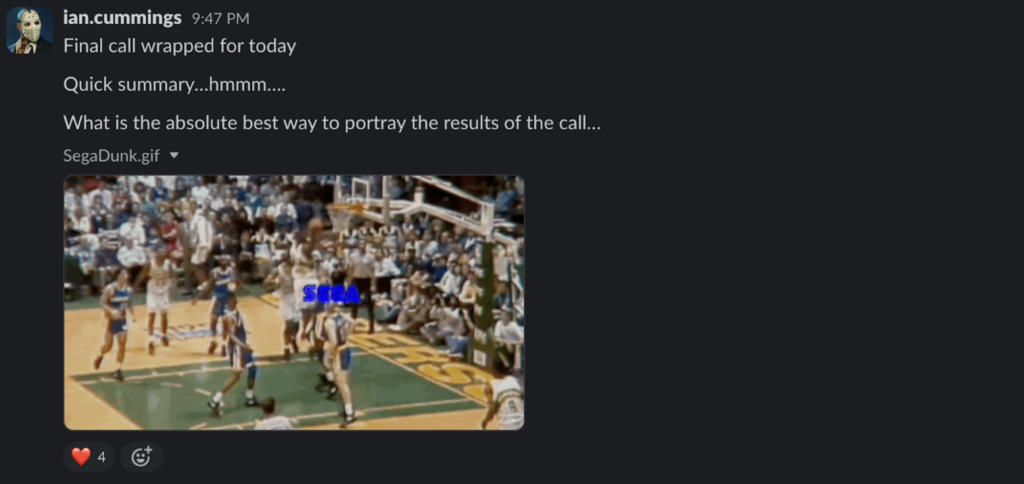

At the advice of our lead investor LVP, I spent much of September and October 2022 practicing and honing our pitch deck. These guys are master-class at crafting these decks and I felt like we made such major strides that this was going to be a cakewalk. We booked a ton of meetings with funds that were pretty deep in the game industry, and I’d get out of these meetings feeling like I absolutely crushed it. I’d just be posting various dunk gifs in Slack over and over again.

Boy was I wrong!

The FTX debacle (combined with the previous crypto implosions in 2022) had really spooked every gaming-forward investor. They’d inevitably string us along for a few weeks, ask for data rooms, then pass saying things like ‘we’re not sure crypto gaming can work’.

I probably did around 60 pitches to investors from November through March. More than 50 got to second meetings or deeper diligence. So I felt like my pitch was working. It wasn’t like I was up there stuttering through a bunch of bad ideas and buzzwords, but I was just unbelievably frustrated that none would go over the finish line. They’d say they needed more time to see more traction, or more details on regulatory compliance. We’d send more data, and inevitably they’d ghost or wait 3 weeks and pass.

In the meantime we were burning through runway. We had expanded the team pretty rapidly and now were really left with some tough decisions. As February rolled around with still no checks coming through I had to reduce our spend by letting go quite a few super talented people. We were able to close a smaller chunk of the round with the absolute legendary investment office of Big Brain Holdings to keep things running relatively normally, but things were starting to get stressful. I stopped taking a salary… wife was super pumped.

Nevertheless, I persisted!

Meeting after meeting, slow-play after slow-play, I kept up the grind. I started meeting with more crypto-focused funds who I had heard were still deploying. They didn’t necessarily understand as much about the game mechanics but they were also not as scared about crypto. In late March I ended up getting a call with a random VC I didn’t know very well and I thought it went pretty terribly. One of the actual only calls where I felt like ‘man, that was really not a fit’. Out of nowhere though, they send this huge due diligence Q&A form, featuring some of the weirdest questions I’d ever seen like “Do you think about Farmville at all as an inspiration?” I answered everything as best I could and lo and behold, out of nowhere, a week or so later they say they’re going to lead the round.

Mind blown! I remember telling the team “I dunno, I actually hope this doesn’t go through because I’m not sure we’re a fit”. But a man starving for 6 months won’t turn down a meal.

Once they confirmed they were in, an avalanche of other teams who were on the fence also came through. The VC FOMO is real. What was an absolutely painful and arduous process for half a year became an oversubscribed round within a week. I was turning down meetings and money…couldn’t believe it.

Narrator: He shouldn’t have done that.

As April dragged into May and June, we still hadn’t closed. CONSTANT requests for changes from this lead. I’m watching our runway evaporate. I loaned in the entirety of my savings to the company to keep making payroll. I start using a credit card to cover a ton of expenses, building it upwards of $100k in debt. We had a dead stop date of June 16 that the wire was to hit. All other investors waiting with the lead wire to hit before they send theirs in.

So June 16 comes, and I have an extremely contentious call with this lead. They demand more changes. Accuse me of not doing this and that. I finally draw a line in the sand and say enough is enough. And then they just say “alright we’re going to pass on the deal”. I say “good” and hang up. Were they ever even serious and going to fund? I honestly don’t even know.

A wave of relief washes over me that I don’t have to permanently be in bed with an investor that I knew I could never see eye to eye with.

Which is followed quickly by absolute panic. I have a full team of veteran (read: expensive) engineers. I have at least $15k a month in server bills. $17k a month in health care bills. I have 2 new hires starting the following Monday. Credit cards are almost maxed. Enough money in the bank for half a payroll. And a community of players that are die-hard and having a great time. The last thing I can imagine is shutting this game down when it’s ACTUALLY WORKING.

Talk about a freakout man.

Seems there’s only two options when you’re in this spot as a founder though. Curl up and die or grind your ass off and find a way. I don’t know how to quit really, so I hammered my entire network the entire weekend and following week. Happened to find a close friend and former boss / coworker who runs a game studio, they needed some contract work done. Got the deal closed within 2 weeks – an amazing deal where we loan some of our engineering resources to them at a premium. So this, along with some pretty brutal pay cuts, at least kept the lights on while I could try and resurrect the rest of the round. I also had to become lead engineer again, doing the majority of the dev work on Photo Finish while the other guys knocked out contract work. “I’ll sleep when I’m dead” I believe was my motto for the summer.

Enter Sfermion!

This was an investment team where every single meeting I had with them was a joy. We all had the same vibe, laughed about various craziness in the crypto space. These guys were SUPER sharp and we got along great. My biggest worry was of course they’re now spooked hearing that some other fund backed out. Luckily, they’re big brains, and they did the diligence of their own.

But we still had to take some time to recalibrate the round. Reduce the burn rate and figure out some new plans of what the next 2 years or so looked like. After another round of diligence, these guys along with other teams we loved like Reciprocal Ventures, 32-Bit, 6th Man joined in. Took nearly a year and massive pain – but isn’t it wild to look at what’s happened just with the $CROWN token for example since the times were so dark?

But back to the early point from our narrator. I absolutely learned a lot through trial by fire here. I’ll pass 3 sage bullet points of advice on to you, fellow startup enjoyoooooooor:

- Never stop fundraising: Though it’s possibly the worst part of the job, you should never stop until the wires have hit. I likely could have closed the round back in April / May easily if I had just let others come in and try and lead. But I was so burned out from the previous 6 months of grinding that when the first “yes” came in, I basically stopped

- Preserve capital: Duh. But assume fundraising is always going to take longer than you think.

- Culture Fit Matters: Even if you’re starving, maybe you do have to turn down a meal. Could have saved myself a ton of anxiety, pain, and suffering if after that first set of weird questions I said “yeah you know it seems like we’re not on the same page here, thanks for your interest”.

Onwards, Upwards

With this phase behind me I’m actually right back out on the fundraising trail. Photo Finish™ LIVE has grown massively in users, revenue, etc all while maintaining absolutely world class metrics for retention and engagement. We have a very special game on our hands. So I’m going to follow my own advice and keep fundraising to get strategics as well as fill out marketing and liquidity budgets. Scared money doesn’t make money!

I’d be remiss to not thank the entire Third Time team and their families as well for the sacrifices THEY had to make during this crazy ass summer. A special crew.

Hope you enjoyed this harrowing read – see you all on the track.

Ian Cummings

Founder / CEO